Project Vetri

An Education Campaign by First Humanity Foundation Campaign Vision

"Every child deserves the power of knowledge to write their own story of success."

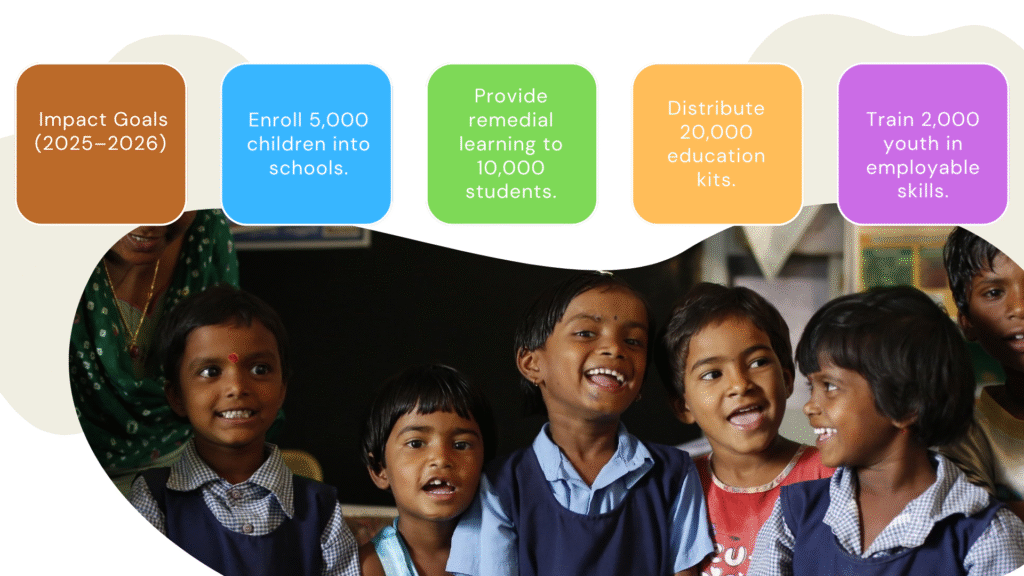

Project Vetri is a mission-driven education campaign by First Humanity Foundation aimed at ensuring access to quality education for underprivileged children and youth. The campaign seeks to break the cycle of poverty by empowering young minds with knowledge, life skills, and opportunities.

Access to Education

Identify children out of school and bring them back to classrooms.

Quality Learning

Provide remedial education, digital learning tools, and creative teaching methods.

Skill Development

Build awareness among parents and communities about the importance of education.

Community Engagement

Build awareness among parents and communities about the importance of education.

Sustainable Support

Partner with schools, volunteers, and donors to create long-term educational impact.

Project Vetri

An Education Campaign by First Humanity Foundation Campaign Vision

"Every child deserves the power of knowledge to write their own story of success."

Project Vetri is a mission-driven education campaign by First Humanity Foundation aimed at ensuring access to quality education for underprivileged children and youth. The campaign seeks to break the cycle of poverty by empowering young minds with knowledge, life skills, and opportunities.

Every Child Deserves the Power of Knowledge to Write Their Own Story of Success !

Frequently Asked Question

All donations made to Project Vetri (Save the Children India) are 50% tax-exempt under section 80G of the Income Tax Act 1961. Section 80G of the Income Tax Act allows tax exemptions for various entities, including individuals, Hindu Undivided Families (HUFs), companies, and partnership firms. Its benefits are also available to Non-Residential Indians (NRIs).

Project Vetri will provide your details to the Income Tax department by May 31, i.e. immediately following the financial year in which the donation was received. We will provide your Full Name, PAN number, and Complete Address to the Income Tax department to issue a Tax Exemption Certificate (10BE).

Visit the Bal Project Vetri donation page, where you will find two options

- One-Time Donation: Choose this option if you want to make a single contribution.

- Monthly Donation: Opt for monthly donations to provide sustained support.

Select your preferred payment method. Ensure you provide your full name, address, and PAN number, to claim tax exemption.

Donating online is cost-effective as it does not require regular visits to field offices or call centres. It is also faster, as online donations are instantaneous. Online donation generates instant documentation, which is sent to the donor's email address, ensuring transparency and ease of access - useful when filing a tax rebate.